Office furniture depreciates every year. This depreciation is calculated in percentages, taking into account the estimated useful years of the furniture. A flat 5% depreciation is associated every year with office furniture which is expected to last up to 20 years.

Table of office furniture depreciation rates

| Product | Estimated years of use – GDS | Depreciation rate |

| Office desks | 7 | 14% |

| Office chairs | 7 | 14% |

| Office fixtures | 7 | 14% |

| Office cabinets | 7 | 14% |

| Office filling cases | 7 | 14% |

| Office slipcovers | 7 | 14% |

| Office upholstered furniture | 7 | 14% |

| Other wooden furniture | 7 | 14% |

Table of other office supplies depreciation rates

| Product | Estimated years of use | Depreciation rate |

| Bookkeeping equipment | 8 | 13% |

| Billing machines | 8 | 13% |

| Lockers | 25 | 4% |

| Display cases | 20 | 5% |

| Perforators | 10 | 10% |

| Water coolers | 10 | 10% |

Depreciation history and the IRS

Office furniture depreciation history is closely tied to the depreciation rates of all other goods. It is a matter in the hands of the IRS. Responsible with tax collection in the US, the IRS updates the depreciation rate according to a fixed method approved by the US congress since 1971 and later updated in 1981 and 1986. These calculations were know known as the ADR (Class Life Asset Depreciation Range). The current system is defined by the MACRS (Modified Accelerated Cost Recovery System).

Can office furniture be depreciated?

Yes, office furniture can be depreciated. But not all properties can be depreciated. Land can’t be depreciated. However, business assets are depreciated, and they include office furniture. With these, a business can also depreciate a building or any vehicles used for commercial purposes.

These are the conditions for office furniture to be depreciated.

- Office furniture needs to be owned and not rented

- Office furniture must be used for business purposes

- Office furniture must have a determined useful life (exception can apply to historic pieces)

- Office furniture needs to have an expected life longer than a year

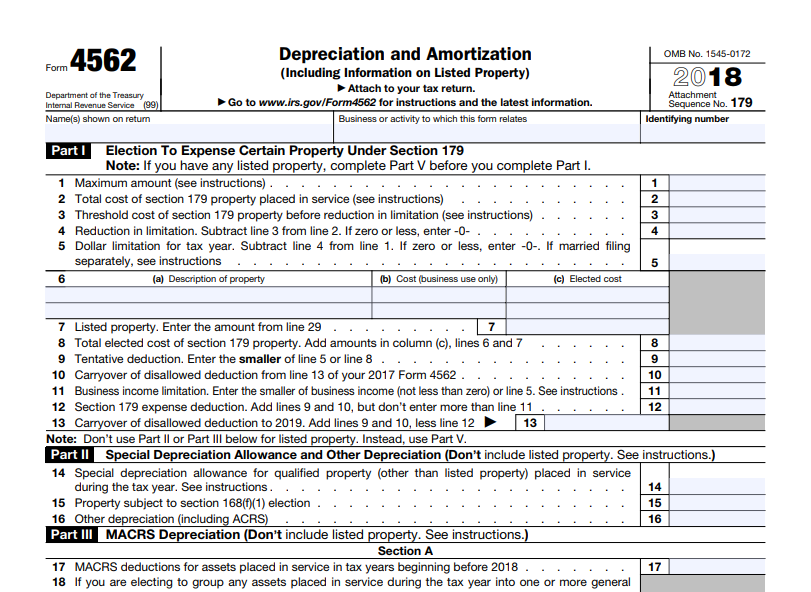

What is Section 179?

The IRS tax code allows businesses to deduct the full price of purchase of expenses such as those with office furniture.

How to apply for office furniture depreciation with Section 179

Under the IRS guidelines, Section 179 allows businesses to limit yearly expenses by putting a cap on taxable business income. Section 179 is a tool which accelerates the depreciation of the assets or which reduces the taxable income of a business. This is made by legal terms. In other words, depreciation is seen as an expense. We all know expenses are not part of the taxable income of a business.

Note: the Section 179 deduction can only be applied to goods purchased within a year.

While there are a few online calculators showing the depreciation rate of office furniture, Section 179 allows us to calculate it on our own. Here are 3 examples of how office furniture depreciation can be calculated.

| Asset | Date of purchase | Cost | Depreciation rate calculation |

| Office desk | January 1st | $10.000 | 7 years depreciation rate = 12 months X 7 – 84 months

For the calculation 12/84 = 14.2% or 1/7 = 14.2%

14% X 10.000 = 1.420

The yearly depreciation is $1.420 This depreciation can be deducted each year for the office desk for a period of 7 years.

|

| Office chair | January 1st | $900 | 7 years depreciation rate = 12 months X 7 – 84 months

For the calculation 12/84 = 14.2% or 1/7 = 14.2%

14.2% X 900 = 127

The yearly depreciation is $127 This depreciation can be deducted each year for the office desk for a period of 7 years.

|

| Office shelves | January 1st | $500 | 7 years depreciation rate = 12 months X 7 – 84 months

For the calculation 12/84 = 14.2% or 1/7 = 14.2%

14.2% X 500 = 71

The yearly depreciation is $71 This depreciation can be deducted each year for the office desk for a period of 7 years.

|

Are there downsides to using depreciation for your office furniture purchases?

- There are downsides to the depreciation system of Section 179. For example, office furniture can be depreciated to zero within 7 years. If the furniture were to be sold, for example, with $3.000, this sum would need to be reported as income.

- The second problem comes with possible depreciation below zero and the increasing number of assets which can be depreciated in the future. The depreciation cannot go below zero in business expenses. If the business expands in the future, there are no more deductions to be made if the taxable expenses are already on zero.

How office furniture depreciation rates reduce taxable income

Most businesses set the depreciated rate for office furniture within the first year of purchase. This can help them reduce the total taxable income, even down to zero.

Let’s see this in a real-world example.

Business A has total sales of $20.000 per year. From this sum, the business needs to pay all utilities and taxes as follows.

- Rent $2.000

- Office supplies $1.000

- Wages $1.000

- Utilities $.1000

- Taxable income before depreciation is $15.000

- Normal depreciation expense $1.400

- Section 179 depreciation $13.850

This means the net business taxable income after Section 179 depreciation is $0.

A few general notes on office furniture depreciation under Section 179

- The depreciation must be claimed in the year of purchase

- The claim can carry over to the next year

- Section 179 has a $1M limit in deductible expenses

- Bonus Depreciation applies after Section 179 depreciation and it aims to go over this limit

- Section 179 deduction can be applied to a few leased products

How do I take office furniture depreciation rates?

Office furniture depreciation rates can be discussed with a tax professional or accountant. First, the business needs to purchase the furniture. All the records with the date of purchase and the sum need to be handed over to the tax professional. Even delivery and setup cost bills need to be handed over as they are part of the total expenses.

There is a standard form use for depreciation. The IRS 4562 form is used for this purpose. The role of the form is to actually centralize all information on the office furniture.

Final words

Further tips on office furniture depreciation rates can be discussed with a tax professional. Large business need to keep in mind the maximum allowance has changed since 2018 and it is bound to change again. So over the next 5-7 years, the maximum allowed depreciation can change and this means large businesses might need to plan their taxable income deductions with some margins for error.

Another aspect to consider is the actual class life in years, which can vary even for office furniture. If the class life of the office furniture is 10 years, it can be recovered in different periods (7 years on GDS under MACRS and 10 years under ADS). All of these details can be planned with a tax professional as most acquisitions can be added to a lower taxable income, next to office furniture.